This added extra fees for things like speeding or making incorrect turns, in addition to the existing penalties. These obligation costs could amount to $1,000 a year. Those that stopped working to pay had their motorists' licenses put on hold. "It was basically a transgression charge," claims Joshua Rivera of the University of Michigan.

Scoring inadequately on any of these outcomes in a higher rate. Loretta, an Uber driver, claims her insurance policy expenses exceeded her car settlements when she resided in Detroit. When she moved 30 miles away, her costs halved (low cost auto). Insurance coverage companies might create very easy targets, however condemn truly exists with the state of Michigan, which has actually placed negative policy in position and also stopped working to repair it.

It is the only American state that mandates such kindness. Initially, the hope was that the no-fault system would simplify claims and lower the number of legal actions.

Various other states have actually reduced such expenses by setting ceilings on what healthcare facilities can bill. Michigan has not. Clinical expenses for those injured in vehicle accidents have actually tripled given that 2000. Ballooning clinical prices are the principal root cause of costly insurancejumping from 22% of premium costs in 2000 to 52% in 2013 - cars.

Fraudulence is believed to be rampant. dui. One chiropractor clinic supposedly sent out "chasers" to locate individuals that had actually just recently been in a cars and truck mishap, in order to prompt them to submit a claim. When this insurance program engages with Detroit's high prices of car theft and also the substandard state of Michigan's roads, a fatality spiral takes place.

About How To Lower Your Car Insurance Rate - Liberty Mutual

Insurance policy becomes a lot more expensive, so even more individuals drop it. "The innocent are paying for the wrongs of the worthless," complains Mo, a 40-year citizen of the city. Some business currently market temporary insurance policy, for as low as 7 days, to ensure that drivers can pass muster when they turn up to city offices to renew their enrollment.

I certify as a "safe motorist". It says so on my motorist's permit. I have actually considered changing business, but the estimate are all regarding the same. No issue what the aggravating gecko claims, I never ever appear to "save 15 percent or more" on my auto insurance coverage. When I inquire about the cost, the basic answer is, "Auto insurance coverage is pricey in Florida."Certainly it is.

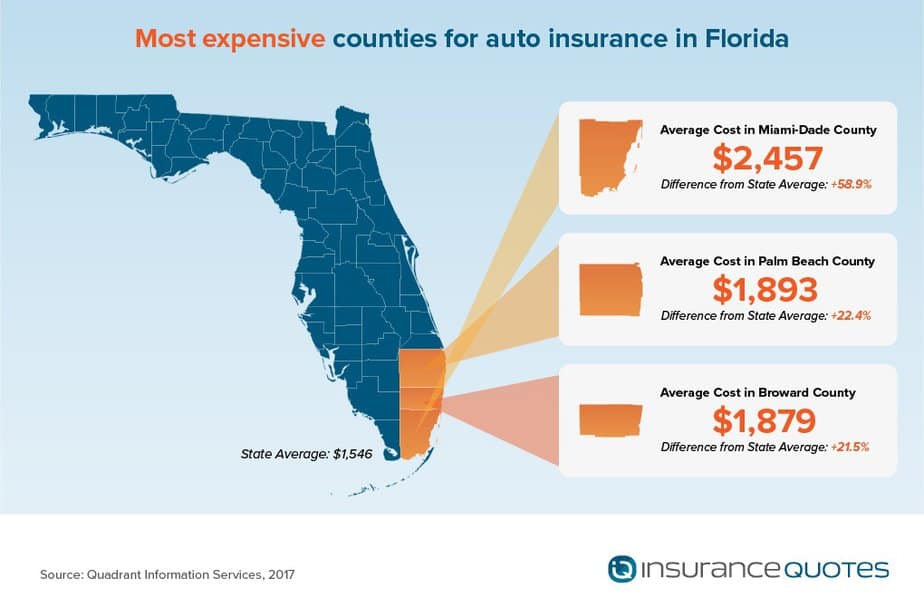

Insurance rates also differ within the state. Vehicle drivers in Gainesville paid the least expensive, according to Purse, Hub (cars).

And the state has a high portion of college-aged drivers and those over 75-years old, both of whom can pay even more for insurance. dui. Adhere to patterns influencing the regional economic climate, Register for our complimentary Organization by the Bay newsletter, We'll damage down the newest organization as well as consumer news and also understandings you need to recognize every Wednesday.

Age as well as gender are out of our control, however there are points we can do to keep prices in check. Save the NASCAR strategies for the track. Budget, Hub located that a speeding ticket obtained three months earlier can raise prices by 21 percent. Reckless driving, 23 percent. A DRUNK DRIVING, 27 percent.

Getting My Why Is Car Insurance For Young Drivers So Expensive? To Work

Why Is My Automobile Insurance Coverage So High? Honestly, there could be a few factors why you're paying so a lot for automobile insurance coverage.

Some insurance coverage business also supply good-driver and safe-driver price cuts - vehicle. See if you certify for among these to lower your existing price. Your Insurance Claim History Despite The Fact That it's their task, insurer don't like it when you submit a great deal of claims. And they absolutely do not such as large cases. Anything from a couple minor car accident to amounting to one too several automobiles will certainly increase your costs.

Obviously, you can increase your credit rating gradually. Recognize that while it may be hurting your insurance price, the truth about credit report ratings is that Have a peek at this website they're not an accurate action of your wealth and also not worth stressing about. Sounds weird? Every person states you have to boost your credit rating to be well-off, but what is a credit rating anyhow? Essentially, it's a number that claims you're excellent at obtaining cash as well as paying it backdoesn't matter what remains in your financial institution account, just how much you have actually conserved for retired life and even your earnings.

It's a whole lot easier than you assume and also absolutely worth it. Your Background of Paying for Insurance policy Lapses in protection can trigger your premiums to spike. It's the regulation to have car insurance policy if you own a cars and truck. As well as it's not an excellent appearance if you don't. So, to prevent higher premiums, make certain you've always got automobile insurance policy as long as you own a cars and truck and occasionally even if you don't.

Insurance coverage firms consider the variety of claims made in the location, the crime price as well as the population density. If any one of these are high, your insurance coverage rate will certainly be high also. Your Age and also Gender Think it or not, insurance coverage firms likewise consider age and gender to determine insurance coverage rates (vehicle).

The Best Guide To Mcca Audit: Why Is Car Insurance So Expensive In Michigan?

Some states, like California, Hawaii and also Massachusetts, have actually prohibited insurance coverage business from utilizing age and gender to establish premiums. Regardless, you can still lower your rate by making some of the other modifications we recommend.

Vehicles that do well on safety and security tests, like the Insurance Institute for Freeway Safety test, have lower insurance costs. Look up the safety rankings the next time you're going shopping for a new automobile, or ask your insurance policy representative exactly how it could impact your rate.

Much more on this later on. Are You Bundling? Packing your residence, auto and also various other residential property insurance coverage can really conserve you cash. If you're paying numerous insurance coverage firms, think about bringing every one of your plans under one roofing system for a lower price. You Don't Need To Choose High Car Insurance Policy Premiums Sure, vehicle insurance coverage prices might be in the air in some locations.

cheap auto insurance car cheaper auto insurance insurance

cheap auto insurance car cheaper auto insurance insurance

The fact is that most individuals are overpaying for protection by numerous bucks! If that's you, right here are some methods you can decrease your premiums quickly: 1 - money. Raise Your Deductible If you enter into an accident or a tree branch easily determines to fall on your windscreen, your insurance deductible is exactly how much you need to pay to repair your cars and truck before your insurer begins spending for the remainder.

low cost auto insurance affordable credit vans

low cost auto insurance affordable credit vans

affordable car insurance dui cheap suvs

affordable car insurance dui cheap suvs

You'll pay less for the repair work in the minute, but you're mosting likely to have a lot greater premiums as a result. If you contend least $1,000 saved, raise your insurance deductible! Having a higher deductible ways reduced premiums. That's due to the fact that you're handling even more danger (normally a few hundred bucks extra each year), but you have deposit that permits you to cover it if you obtain in a mishap.

The Of Why Is Car Insurance For Young Drivers So Expensive?

There are likewise plenty of kinds of coverage you can possibly go down from your policy to shave some of the cost from your costs. Below are some insurance coverages you might consider reducing if they're not called for in your state: 3. Package Your Plans Let's say you have actually got house owner's insurance policy as well as vehicle insurance policy by two various insurance policy providers.

It's a good way to comfortably handle your plans as well as conserve cash on premiums, particularly if one of them is costly. Some companies say they can conserve you up to 25% on your insurance coverage (accident). That's even more cash in your pocket as well as less money going to the insurance company. Good! You're additionally less likely to be dropped from your insurance provider if you have actually got several policies with them.

Depending upon what you need, acquiring private insurance policies can conserve you much more. credit. For instance, allow's claim you've obtained a modest vehicle as well as an expensive home. If the company uses a bundle with expensive cars and truck insurance however inexpensive house owner's insurance coverage, you may find better protection at a better deal by separating the bundle.

Shop Around for Automobile Insurance Think about it: When was the last time you went shopping around for cars and truck insurance policy? Was it when you purchased your automobile? If you have a clean driving record, contrasting quotes might conserve you hundreds of bucks.

Or a great deal of individuals make the mistake of collaborating with an agent who can't (or will not) contrast quotes from different insurance provider - money. You want somebody that is committed to getting the most effective bargain for younot for the insurance policy business that pays them. And also, they understand all the added discounts to look for.

Survey: Louisville 8th-most Expensive City For Car Insurance Fundamentals Explained

cheap auto insurance laws cars dui

cheap auto insurance laws cars dui

Ramsey backs relied on experts in your location called Endorsed Citizen Providers (ELPs). They will help you compare prices and find the right coverage at the best cost. cheapest car insurance. That means, you recognize you're getting the many bang for your buck when it involves automobile insurance policy! (credit).