You'll pay higher automobile insurance policy costs than a vehicle driver with a clean document and also you'll be limited in your option of insurance providers. See what you can conserve on cars and truck insurance policy, Conveniently compare personalized prices to see exactly how much switching automobile insurance policy could save you.

You may be needed to have an SR-22 if: You have actually been convicted of DUI, Drunk driving or another major relocating infraction. You have actually triggered a mishap while driving without insurance.

Not all states require an SR-22 or FR-44. If you need one, you'll locate out from your state department of motor vehicles or website traffic court.

When you're alerted you need an SR-22, begin by contacting your car insurance provider. Some insurance providers don't offer this solution, so you might require to purchase a firm that does. If you do not already have car insurance policy, you'll most likely require to buy a policy in order to get your driving benefits brought back - sr22 coverage.

Insurance policy quotes will additionally differ depending on what automobile insurance coverage firm you pick. See what you could conserve on automobile insurance, Conveniently compare personalized rates to see exactly how much changing auto insurance coverage can save you.

The Main Principles Of Sr-22 - Insurance Glossary Definition - Irmi.com

Place issues. As an instance, think about a vehicle driver with a recent DUI, an infraction that may result in an SR-22 demand. Geek, Wallet's 2021 price analysis discovered that out of the country's four largest companies that all submit an SR-22, insurance rates usually were most affordable from Progressive for 40-year-old drivers with a current DUI.

In the majority of states, an SR-22 demand lasts 3 years. If your policy lapses while you have an SR-22, your insurance firm is needed to notify the state and your permit will be put on hold. When your need finishes, the SR-22 does not instantly diminish your insurance plan. Make certain to allow your insurance provider know you no more need it.

Fees generally stay high for 3 to 5 years after you have actually created a mishap or had a moving infraction. If you look around simply after the 3- as well as five-year marks, you may find lower premiums (sr22 insurance).

Which states require SR-22s? Each state has its own SR-22 coverage demands for vehicle drivers, as well as all are subject to change (underinsured). Contact your insurance policy supplier to figure out your state's current needs and also make sure you have adequate coverage. The length of time do you require an SR-22? Many states call for drivers to have an SR-22to show they have insurancefor regarding three years.

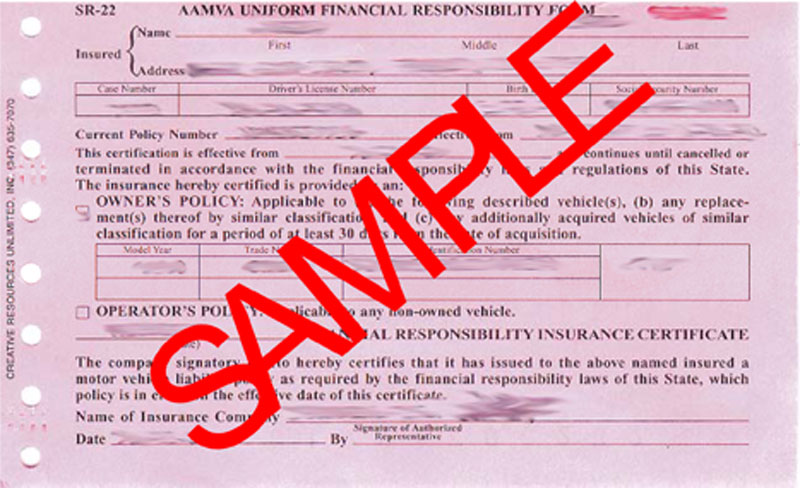

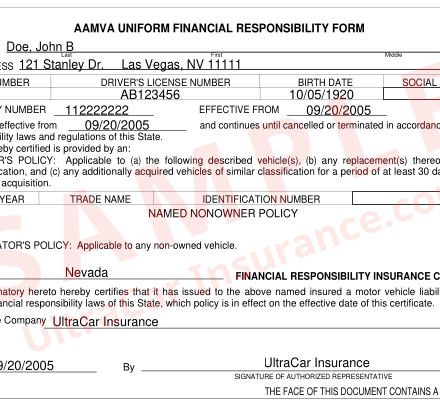

What is an SR-22? An SR-22 is a certificate of financial responsibility required for some drivers by their state or court order. An SR-22 is not an actual "type" of insurance, however a type submitted with your state. This form offers as proof your car insurance coverage satisfies the minimal obligation coverage needed by state law.

Free Texas Sr22 Filing - Abc Insurance Services Can Be Fun For Everyone

vehicle insurance sr22 insurance sr-22 auto insurance insure

vehicle insurance sr22 insurance sr-22 auto insurance insure

Do I require an SR-22/ FR-44? Not every person requires an SR-22/ FR-44. Rules differ from state to state. Usually, it is called for by the court or mandated by the state just for sure driving-related offenses. : DUI convictions Reckless driving Accidents triggered by without insurance vehicle drivers If you need an SR-22/ FR-44, the courts or your state Motor Vehicle Division will certainly inform you.

Is there a charge connected with an SR-22/ FR-44? This is an one-time cost you must pay when we submit the SR-22/ FR-44.

A filing charge is charged for each specific SR-22/ FR-44 we file - insurance companies. If your spouse is on your policy and both of you require an SR-22/ FR-44, after that the filing fee will be billed twice. Please note: The fee is not included in the rate quote since the filing cost can differ.

Your SR-22/ FR-44 needs to be valid as long as your insurance policy is energetic (insurance coverage). If your insurance coverage plan is terminated while you're still called for to lug an SR-22/ FR-44, we are needed to alert the proper state authorities.

That "uh oh" moment. You've been told you need this point called SR22 insurance coverage. Do not stress, we obtained this. We're right here to aid you - division of motor vehicles. Convenient declaring. Genuine. There's no paperwork. Call us for a cost-free quote at ( 773) 202-5060 or you can get covered online in 2 mins. We'll help you obtain your SR22 Instantly. Obtained a letter from the State of Illinois to confirm your insurance coverage? No trouble.

Some Of Houston Sr-22 Insurance

Immediate SR-22 Insurance Coverage Filing If your permit has been suspended, withdrawed, or you have actually had a DRUNK DRIVING, a might be needed to reinstate your driving benefits. Required SR22? When you obtain a plan with Insure on the Place, a record is submitted to the state validating that you have protection.

At fault Accidents, Depending upon the extent of a mishap, if you have actually been located to blame for a crash, you may also be bought by the courts to maintain an SR-22 for a collection duration of time. Several Infractions, Those who rack up numerous smaller sized web traffic infractions in a short amount of time may need to submit an SR22.

Just How Does SR-22 Insurance work? If a chauffeur needs to submit an SR-22, they will get a court order alerting them of their demands. It is the driver's duty to consider that details to their state's Department of Motor Autos (DMV) or Bureau of Motor Vehicles (BMV). You may have concerns if your company is not accredited in the state requesting an SR-22 certification.

Staying in a various state does not indicate your SR-22 needs vanish. If your insurance coverage business is not accredited in the state requesting the SR-22, you will certainly need to directly send the SR-22 kind with that said state's DMV.If the procedure is frustrating, speak to the state's Division of Motor Vehicles or your representative for aid on your state's requirements.

Sr-22: What You Need To Know - Freeway Insurance Fundamentals Explained

SR22 Insurance Policy Prices, Exactly how a lot an SR-22 filing expenses varies by state. Chauffeur's generally pay around a $25 filing cost for declaring SR-22 insurance.

Satisfying your state's needs must be a concern, yet you want to find a quote with a policy that is inexpensive. With nearly every company supplying a quote online, your chances of locating wonderful insurance coverage at an also better price may raise. Will an SR-22 policy affect my insurance follow this link policy price? Yes.

Constantly be planned for greater coverage prices after the filing. Just How to Lower Auto Insurance Coverage Rates After an SR-22 policy, Your car insurance policy premiums are bound to increase adhering to an SR-22 demand as well as you're mosting likely to wish to locate a method to reduce them. While they may never ever be as reduced as they were pre-SR-22, there are still some means to make them suit your budget better (insurance).

ignition interlock insurance companies division of motor vehicles car insurance insurance

ignition interlock insurance companies division of motor vehicles car insurance insurance

underinsured insurance ignition interlock deductibles sr-22 insurance

underinsured insurance ignition interlock deductibles sr-22 insurance

The higher your insurance deductible is, the much less your insurance policy premiums will be. It is important to remember that once you establish your deductibles at a specific quantity, you require to make certain that you can really pay it following an accident.

It's useful to go shopping around and profession in your car for one that's a couple of years old with excellent security ratings. You will appear to be much less of an insurability threat to your insurance coverage supplier (division of motor vehicles).

Examine This Report about Sr-22 For Revocations/suspensions

If you are still displeased with your insurance policy premiums, ask your insurance coverage representative about any kind of price cuts you are eligible for - driver's license. Agents are well educated of the basics of all type of discount rates you can obtain. Canceling or Eliminating Your SR-22 Coverage, Even if you are certain your SR-22 period is up, calling your states Department of Motor Autos or DMV confirming that is an excellent concept.

Carrying only the state minimum coverage will usually not suffice when you need an FR-44. This, subsequently, will certainly raise your vehicle insurance policy rates. An FR-44 certificate is required for three years generally, as well as it additionally can not be canceled prior to the expiry day. SR-22 Frequently Asked Concerns, Exist different kinds of SR-22s? There are three choices when purchasing an SR-22 certification from your insurance firm, Owner, Operator, and Owner-Operator (division of motor vehicles).

Operator - A Driver's SR22 Kind is for motorists that borrow or rent an automobile rather than possessing one - liability insurance. This may also be coupled with non-owner SR-22 insurance and also can supply a cheaper option if it's difficult covering the cost of an SR-22. Operator-Owner - The Operator-Owner's SR22 Form is planned for motorists who both possess an auto however periodically, rental fee or borrow an additional cars and truck.

dui department of motor vehicles underinsured no-fault insurance liability insurance

dui department of motor vehicles underinsured no-fault insurance liability insurance

It goes together with your auto insurance coverage plan. How Can I Find The Most Affordable SR22 Insurance Policy Near Me?

National insurance provider are not anxious to supply insurance coverage for a person who requires SR22 insurance policy. You might have much better good luck with regional companies as they often will cover high-risk chauffeurs, which you will be thought about with your SR22 demand. Make certain to get SR22 quotes from every insurer you discover as well as examine all the SR22 plans available on the market. vehicle insurance.

The Basic Principles Of Sr-22: What You Need To Know - Freeway Insurance

Does SR-22 Insurance Cover Any Automobile I Drive? Yes, your SR22 insurance will cover any automobile you drive so long as you have owner-operator SR22 insurance - sr22 insurance. An owner-operator SR22 certification is a sort of SR22 kind that permits you to drive any kind of car, despite that possesses it, and also still be identified as an insured driver with a legitimate SR22.

insurance companies car insurance sr22 coverage sr22 insurance insurance group

insurance companies car insurance sr22 coverage sr22 insurance insurance group

Proprietor SR22 insurance is an SR22 form that only allows you to drive automobiles that you own. Non-owner SR22 insurance coverage is the least expensive choice however is only for people that do not own a vehicle yet they frequently drive, whether it be from renting out or borrowing somebody else's automobile. It relies on what your automobile ownership standing is when it pertains to whether your SR22 will rollover to cars you drive.